Be Your Own Bank is another way to refer to Nelson Nash’s Infinite Banking Concept: Becoming Your Own Banker®. To be your own bank means you replace conventional thinking and take back control of your money outside of Wall Street, using a properly structured whole life insurance policy designed to maximize cash value growth.

In the following article we will discuss how you can be your own bank and the advantages and disadvantages of being your own banker, as well as look at the benefits of whole life insurance and why it makes such a great self banking system. (Please follow the links in this article for more information on the topic of being your own banker.)

Infinite Banking: Secrets to Becoming Your Own Banker

Step 1: Research

The first step to be your own bank is to realize what the phrase means. It does NOT mean you are actually creating a bank. Rather, to be your own bank signifies a huge paradigm shift in your thinking that puts you in the control seat of your money, rather than Wall Street, as you put on your banker’s hat and start to think like a banker does.

The first step to be your own bank is to realize what the phrase means. It does NOT mean you are actually creating a bank. Rather, to be your own bank signifies a huge paradigm shift in your thinking that puts you in the control seat of your money, rather than Wall Street, as you put on your banker’s hat and start to think like a banker does.

Step 2: Choose An Asset

The second step on your way to becoming your own banker is choosing a financial asset from which to be your own bank. You see, when it comes to being your own banker, specific financial vehicles work better than others. And that is why an infinite banking policy using dividend paying whole life insurance, built to maximize cash value growth, is the optimal vehicle to use for an infinite banking strategy.

The second step on your way to becoming your own banker is choosing a financial asset from which to be your own bank. You see, when it comes to being your own banker, specific financial vehicles work better than others. And that is why an infinite banking policy using dividend paying whole life insurance, built to maximize cash value growth, is the optimal vehicle to use for an infinite banking strategy.

Step 3: Build Your Bank

The third step is to have an expert design your whole life insurance banking policy. To get the most out of your banking policy you need to have the proper mix of base premium and paid up additions. This is not a traditional whole life insurance policy but a high cash value whole life insurance policy that focuses on cash value accumulation and growth.

Step 4: Fund Your Bank

You need to capitalize your banking policy by paying your life insurance premiums and paid up additions. You are overfunding life insurance by stuffing as much money into the cash value account as possible, while still maintaining the status of a life insurance policy. There are specific limits set by the internal revenue code that limits how fast you can overfund life insurance without its status being changed from life insurance to a modified endowment contract.

You need to capitalize your banking policy by paying your life insurance premiums and paid up additions. You are overfunding life insurance by stuffing as much money into the cash value account as possible, while still maintaining the status of a life insurance policy. There are specific limits set by the internal revenue code that limits how fast you can overfund life insurance without its status being changed from life insurance to a modified endowment contract.

Step 5: Buy Assets or Pay Off Debt

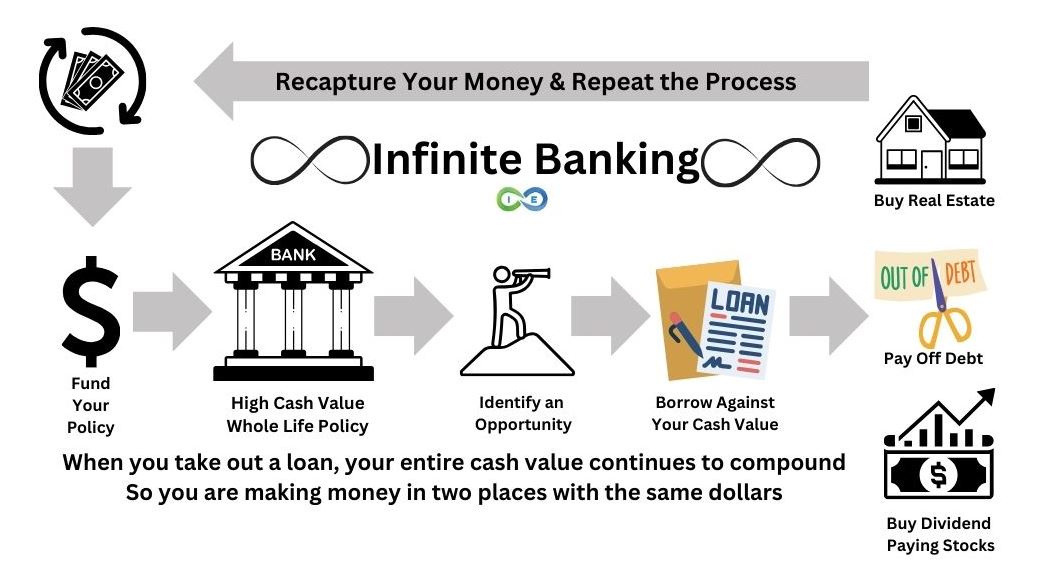

Once you fund your infinite banking policy, your money can then be used for other purchases or for paying off debt.You do this by taking our a loan, using your cash value as collateral.

Once you fund your infinite banking policy, your money can then be used for other purchases or for paying off debt.You do this by taking our a loan, using your cash value as collateral.

Using your cash value as collateral allows you to maximize your dollars because your dollars are working in two places simultaneously. You see, when you take out a loan you are still earning interest on your entire cash value account. So your money in your cash value account is growing with interest and dividends, and your money is also growing in the asset you purchased with your life insurance loan money.

Alternatively, you can also use this strategy of being your own bank to pay off debt. We have an in depth article on the subject of using life insurance to pay off debt faster, and while you are still alive. Click on the link for more on this strategy.

Step 6: Recapitalize Your Bank

The next step in being your own bank is to pay back your loan. You want to recapitalize your banking system by putting your dollars back into your policy so that when the next opportunity arises you are ready to pounce.

The next step in being your own bank is to pay back your loan. You want to recapitalize your banking system by putting your dollars back into your policy so that when the next opportunity arises you are ready to pounce.

Which brings us to step 7….

Step 7: Repeat the Process

The idea behind becoming your own banker with infinite banking is to fund your policy, purchase cash flowing assets, and then use the money from your other assets to replenish your banking system and then repeat the process over and over.

The idea behind becoming your own banker with infinite banking is to fund your policy, purchase cash flowing assets, and then use the money from your other assets to replenish your banking system and then repeat the process over and over.

Now that we have covered how to be your own bank, let’s take a look at all benefits that being your own banker brings.

The 7 Benefits of Becoming Your Own Banker with Whole Life Insurance

In our pros and cons of infinite banking, we covered the advantage and disadvantages of using whole life insurance as your bank. We list five such benefits below.

1. Safety

Choosing to structure an infinite banking life insurance policy from among the highest rated life insurance companies provides you with a stable foundation to build from. Many of these carriers are mutual insurance companies, that have been around for over 150 years.

In 2008 we learned that many financial institutions are not as stable as life insurance companies since they often take on huge amounts of risk, often leveraged out to dangerous levels. And many banks are active in the derivatives market, which should be cause for some concern. During the first half of 2023, the notional amounts of outstanding interest rate derivatives saw a 17% increase, reaching $574 trillion, while foreign exchange derivatives experienced a 12% rise, amounting to $120 trillion. Source.

In contrast to the high risk associated with Wall Street, your whole life insurance is not an investment, but a savings vehicle that acts as your “Safe Bucket”. It provides you with a solid financial foundation to transact your own personal financing from, that is separate from Wall Street and big banks.

2. Uninterrupted Compound Interest

Your whole life insurance policy should be designed to create early high cash value growth. The designs of infinite banking whole life insurance policies are not focused on death benefit, but on cash value accumulation and growth via a paid up additions rider, which allows you to overfund your whole life insurance banking policy.

The benefit is that even while you have an outstanding policy loan, the entire balance of your cash value in the whole life insurance policy continues to earn interest and dividends. That means your cash value is growing with uninterrupted compound interest, even as you borrow against your cash value and purchase other cash flowing assets.

3. Privacy

Your life insurance cash value and any life insurance policy loans do not show up on your credit report. If you have a large outstanding policy loan, it will not interfere with you qualifying for other types of loans, such as a mortgage loan for an investment property.

Also, you do not have to qualify for life insurance loans. You have a contractual right to withdraw or borrow against your policy whenever you choose, for whatever you choose.

4. Creditor Protection

Another aspect of safety and privacy is whole life insurance creditor protection. Most states have asset protections in place for the cash value in life insurance, so your money is safe from judgments and creditors.

5. Traditional Bank Savings Account vs Whole Life Insurance as Your Bank

When your whole life insurance becomes your bank you gain many benefits versus using a traditional bank savings account. Check the chart below to see how a traditional bank savings account stacks up versus a whole life insurance policy designed for high cash value accumulation.

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of Dec. 18, 2023 (*Bankrate, December 13, 2023). But actual earnings are less after tax and not guaranteed. |

Guaranteed (average) 3% interest. Plus an additional 2%-4% dividends. Tax-free, so net earnings of 5%-7%, which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. Loan would have to be obtained through a bank or other lender. |

Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid – or even IF payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | ~Chronic Illness Rider – With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. ~Accelerated Death Benefit – Death benefit funds may also be accessed in the event of a terminal illness diagnosis. ~Protection from 3rd party creditors – In most states, whole life insurance is protected from creditors, lawsuits, and bankruptcy. |

| Costs | None | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout – which is received income tax free by the beneficiary(ies). |

6. Tax advantaged

Some of the advantages of whole life insurance are tax deferred growth, tax free policy loans and a tax free death benefit.

The Internal Revenue Code has several section devoted to life insurance, including section 7702. A section 7702 Plan is simply referring to cash value life insurance, and the many tax benefits it receives under the Code.

Within your infinite banking system, your money accrues dividends, has guaranteed growth, enjoys tax-advantaged accumulation, and tax-free use of money. And when you die, your beneficiary receives your death benefit tax free.

7. Leverage

Use your cash value to purchase cash flow assets, such as real estate. This is a great real estate wealth building strategy, where you borrow against your cash value from the general account of the whole life insurance company for the down payment, while the remaining 75-80% of the property is financed through a mortgage loan. By doing this you are using other people’s money, (the insurance company’s and the bank’s), to fund your purchases.

Potential arbitrage is available as you use your cash value as collateral to purchase higher income producing assets. You continue to earn interest and whole life insurance dividends in your policy, but your money is also at work simultaneously in your income producing asset.

You can then take the money you get from your cash flowing asset and use it to repay your loan to the whole life insurance company, so that you can recapitalize your banking policy and repeat the process over and over.

And you don’t have to limit yourself to real estate. This process can be utilized for whatever purchases you need to make, such as buying cars, paying down debt, financing your business pursuits, buying beaten down dividend paying stocks, or whatever opportunity you find.

The idea is that you finance everything you buy, so you might as well be your own banker and charge yourself interest on your money that you are borrowing from yourself, rather than to a bank.

*You finance everything you buy. Nelson Nash

Pay Interest vs Pay Cash vs Pay Yourself

Consider that you either buy on credit, buy with a loan, or buy with cash.

Pay Interest

When you buy on credit you pay interest to the credit card company. You end up paying more for the item than the actual price since you also pay interest. Likewise, when you buy with a loan, you are borrowing the money to make the purchase and you have to pay back the loan with interest.

Pay Cash

And when you buy with cash, you don’t have to pay interest, but you forfeit your opportunity cost of what you could have used that cash for. Now you have to build up your cash balance again and you cannot take advantage of opportunities that might present themselves to you because you have no money.

Pay Yourself

The infinite banking concept taught by Nelson Nash is that by acting as your own banker you are borrowing from yourself and paying yourself back. Essentially, you are recapturing your own money that you used to purchase whatever item you just bought. The money remains in your own money ecosystem (your whole life insurance policy), rather than passing through banks.

By executing the “be your own bank” strategy, it allows for true compound interest growth, as the money remains at work in your whole life insurance policy, even when you borrow against your cash value. You then pay yourself back, recapitalizing your infinite banking policy, so that you are ready to seize the next opportunity when it presents itself.

Next Steps

We know that we’ve gone over a lot of information here, some of which may seem really complicated, but the truth is, the most complicated mechanization behind all of this is simply grasping the idea that a dividend paying whole life insurance policy can be used for so much more than just a life insurance policy with a death benefit.

Once you’ve grasped that concept, understand that a whole life insurance policy used to be your own bank isn’t and “investment” per say. Rather, it’s a change of thought which can fundamentally change the way you use and leverage your money.

Don’t worry if you don’t fully understand all the specifics right away, that’s what we’re here for. We will explain how these types of life insurance banking policies work, what you’ll need to do to qualify for one and help you find the best infinite banking life insurance policy for you!

So, what are you waiting for? Give us a call today or schedule a call with one of our Pro Client Guides and see what we can do for you.

![9 Different Types of Life Insurance Policies [Which is Best for You?]](https://alcimelegacy.com/wp-content/uploads/2024/07/types-of-participating-whole-life-insurance-policies-300x200-1.jpg)